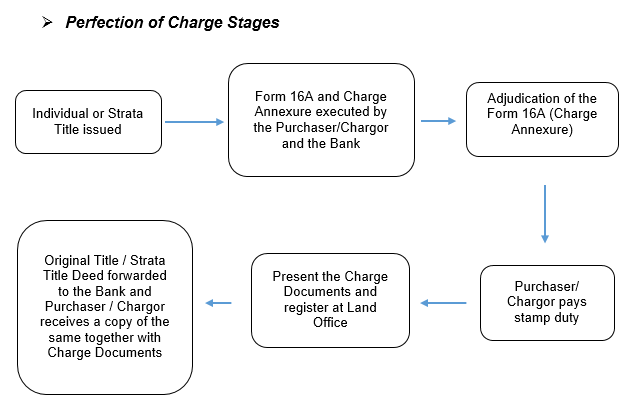

PERFECTION OF CHARGE (POC)

POC is a complimentary process performed together with the Perfection of Transfer. This process is only applicable when the purchaser bought a property via financing provided that the purchaser / borrower has still yet to settle the facility / loan granted by the Bank as of the date when the Individual Title or Strata title of the property is issued. On the other hand, it is a process of perfecting or completing the charge of the property’s title in favour of the Bank upon issuance of the Individual or Strata Title. The primary purpose of POC is to provide security to the Bank where the Bank has the right to initiate legal actions against the property charged in the event the purchaser defaults in the repayment of the loan.

How much should a purchaser pays for stamp duty?

Generally, the stamp duty payable for Perfection of Charge is only RM40.

Documents required for POC:-

- A copy of the Purchaser / Borrower / Customer’s Identity Card;

- A copy of the Property Title Deed;

- A copy of the stamped Facilities Agreement;

- A copy of the latest duly paid Assessment Receipt; and

- A copy of the latest duly paid Quit / Parcel Rent Receipt.

Purchaser is strongly encouraged to engage solicitors in perfecting the titles in favour of them and the Charge in favour of the Bank as soonest possible upon issuance of the Individual or Strata Title to:-

- Enjoy and fully exercise their rights to the property since the purchaser’s name on the duly issued Individual or Strata Title is not reflected as conclusive pieces of evidences and the indefeasible ownership of the property pursuant to the National Land Code 1965 if the Individual or Strata Title is yet to be perfected;

- Sell their property or use the property as collateral at their convenience because the strata title will not show the developer as the registered owner of the property;

- Avoid additional administration fees which may be imposed by the developer as storage charges for the title;

- Avoid additional costs and time which may be incurred in the event the developer wound up and a liquidator is subsequently appointed to attend the POT process;

- Avoid complicated sale transactions; and

- Avoid the difficulties in transferring the property under inheritance or succession in future.

If you have any questions or require any additional information, please contact our lawyer that you usually deal with.

This article is written by

Gwen Yeap Siew Fen

Partner, Low & Partners

Neoh Soon Pei

Legal Associate, Low & Partners

Related Articles

Land Title Conversion in Sarawak

Rights Over the NCR Land

Understanding Legal Due Diligence in Real Estate Transactions in Malaysia: A Comprehensive Guide for Buyers and Sellers

A Management Corporation Imposing Different Rates of Maintenance and Sinking Fund Charges (‘Charges’) In A Strata Property- Yes or No?

Questions? We're here to help